A lot has been mentioned and written about Switzerland’s center class – a socioeconomic group that falls into the median vary of earnings (between the rich and poor) for the geographic space through which they reside. That is what we learn about them.

The Federal Statistical Workplace (FSO) has simply printed figures revealing some info about Switzerland’s center class, together with their wages.

That is what we all know:

Most individuals in Switzerland (almost 60 %) fall into the middle-income group.

This quantity is barely decrease than throughout the eurozone, the place 64 % of the inhabitants are thought-about center class.

Nevertheless, the explanation for it might be that earnings standards for center class differs between Switzerland and the EU – usually, they’re greater in Switzerland as a result of wages are greater as nicely (learn extra about this beneath).

To be thought-about center class in Switzerland, a single particular person should earn between 4,126 and eight,842 francs a month, whereas for a household with two youngsters this quantity falls between 8,666 and 18,569 francs.

When it comes to annual earnings, these figures translate to between 49,513 and 106,104 francs for single people, and 103,992 to 222,828 francs for a household of 4.

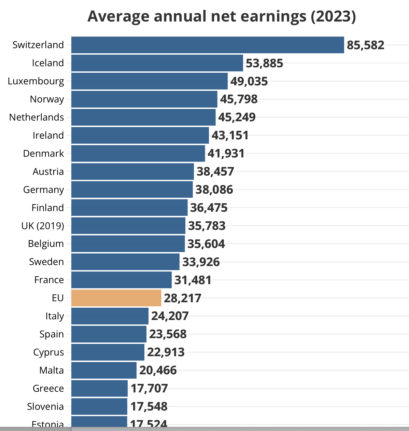

Crunching these numbers additional signifies that the common annual earnings in Switzerland is 85,582 euros (81,735 francs).

This chart exhibits how this common earnings compares to elsewhere in Europe:

Eurostat

However let’s return to Swiss center class and the way it compares, income-wise, with the eurozone.

Based on the Organisation for Financial Co-operation and Growth (OECD) Higher Life Index, a family incomes between 35,000 and 85,000 euros per yr (33,433 to 81,210 francs) is usually thought-about center class within the European Union.

Commercial

In fact, these averages are greater in nations like Luxembourg and Norway, however they’re offset by decrease wages in poorer nations inside the EU.

Swiss averages can’t be taken at face worth nonetheless.

That’s as a result of the price of residing is usually greater in Switzerland (although taxes are decrease).

And that brings us to the topic of buying energy get together (PPP), which is mainly a measure of the costs of products and companies in numerous nations versus common incomes.

Commercial

How is Switzerland doing when it comes to PPP?

An in-depth evaluation by a digital employment platform Glassdoor supplies some fascinating and little question shocking insights into Switzerland’s PPP as compared with different nations.

„Taking not solely earnings and value of residing under consideration, but additionally the results of variations in taxation, it’s potential to derive a sign of after-tax, native purchasing-power-based, lifestyle”, the examine reported.

“On this foundation, the very best total lifestyle is discovered within the cities of Switzerland, Denmark, and Germany. Though the price of residing will be comparatively excessive in these nations, so are common wages and buying energy”.

The examine concluded that “in Switzerland, Denmark, and Germany the common city-based employee can afford to purchase 60 % or extra items and companies along with his or her wage than residents of New York“.

Additionally, should you take a look at the large image – taking numerous components under consideration – the cost-of-living state of affairs just isn’t as dangerous as many individuals consider.

“Varied components” on this context means the low inflation fee (as compared with different nations), excessive employment, and a robust financial system – all of which imply that Switzerland is outperforming different European nations on many fronts.

So should you analyse issues from a distinct angle, Switzerland’s value of residing doesn’t look so dangerous.

READ ALSO: Why Switzerland’s value of residing is not as excessive as you suppose